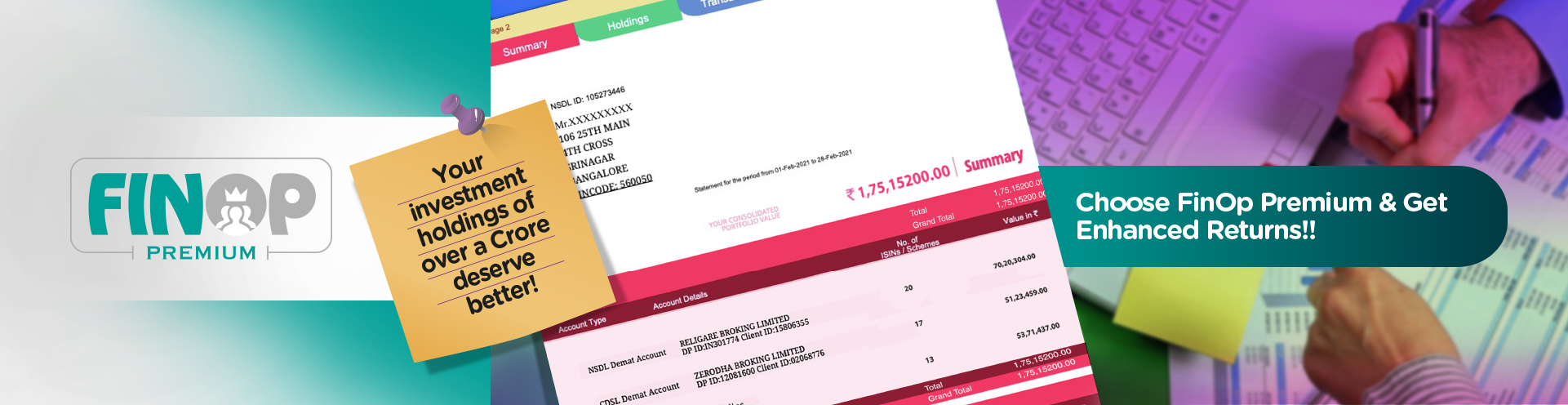

IF you are holding a Portfolio:

You are holding a stock portfolio/ESOPS/Mutual Funds of over 1.25 Cr. AND want your current holdings to get additional returns.

IF You have a Fixed Deposit

You are holding a Bank FD of over 1.25 Cr. AND would be happy if that can enhance safe returns